Your company is off and running, and you’re ready to go to the next level—that’s when you come to us. The Emerging Technology Fund (ETF) is designed to help growing companies like yours find the capital you need.

The ETF makes loans of up to $4,000,000 to technology companies for expansion, working capital, or equipment purchases. Combined with MassDevelopment’s other offerings, we can help you deliver the products essential for a thriving economy.

Frequently Asked Questions

Who’s eligible?

To qualify for the ETF program, you must be a technology company that:

- Is considering launching or expanding manufacturing operations in Massachusetts

- Seeks financing for the purchase, expansion, or improvement of real estate; the purchase of equipment; or working capital for growth

- Will receive financing from two parties other than the ETF

- Can ensure your financial investment benefits the Massachusetts economy

Who do we help?

We help proven technology companies of all kinds looking to expand in Massachusetts, including:

- Advanced Materials

- Communications

- Defense / Homeland Security

- Electronics

- Environmental

- Information Technology

- Medical Devices

- Nanotechnology

- Plastics / Polymers

What are SBIR Bridge Loans?

The Small Business Innovation Research (SBIR) Bridge Loans through the ETF are for Massachusetts-based recipients of federal SBIR grants, which are federal grants that fund research and development projects at small businesses to help them explore their technological potential. SBIR grant awardees typically wait three to nine months for their grant funds; the SBIR Bridge Loans bridge the time between the SBIR award and the time the grant is funded, increasing the value of the SBIR grants by putting the money to work faster.

- Companies that have committed federal SBIR grants may apply.

- SBIR Bridge Loan facilities may be up to $250,000.

- Loans will advance up to 90 percent of eligible grant milestone payments. Loan advances must be repaid when the SBIR grant milestone payments are received.

MassDevelopment will take a first lien on all business assets of the borrowing companies until fully repaid.

What’s the advantage of Venture Debt?

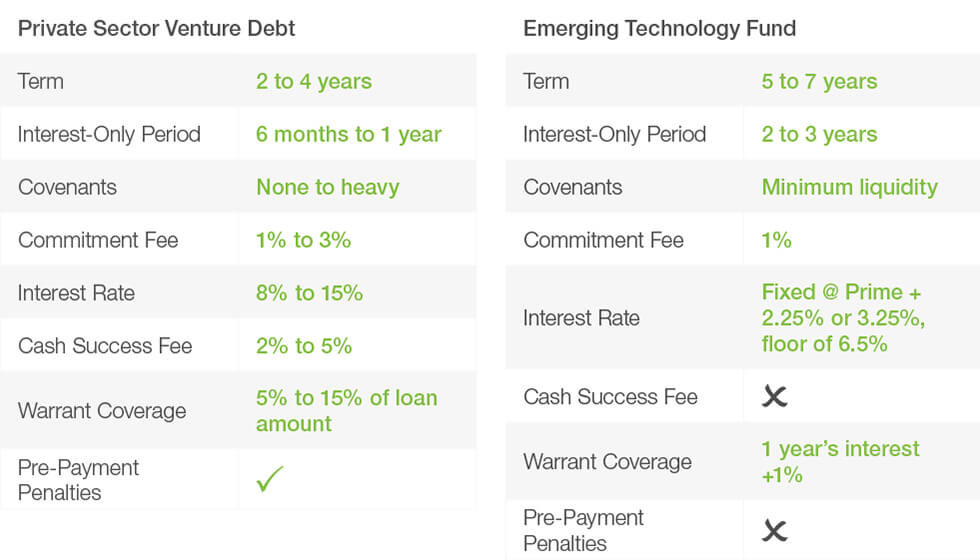

Venture debt provides emerging-growth companies the capital they require without unnecessary dilution. The table below shows typical ranges for terms and costs from the private sector and the Emerging Technology Fund, a venture debt program offered by the Commonwealth of Massachusetts.

Venture Debt Cost Comparison